Welcome

We are pleased that you are interested in Seventh-day Adventist Christian education! Our schools foster a balanced approach to the whole person including physical, mental, spiritual and social development. Curricular activities are based on Scripture with learning outcomes that embrace domains of knowledge, understanding, application, emotions, attitudes and lifestyle.

We encourage the cooperation between home, school, and church to prepare learners to choose and accept God as our Creator and Redeemer and to be good citizens in our communities, the world and throughout eternity.

Extracurricular sports, vibrant music programs, computer and arts classes provide opportunities for students to gain and showcase their skills as part of a well-rounded curriculum. Aviation and CNA certification have also been just some of the programs offered through our secondary school, Thunderbird Adventist Academy, to help prepare students for careers even before graduation.

Your dedication and financial commitment to this program will help ensure that Adventist Education continues to be a choice for all students in Arizona.

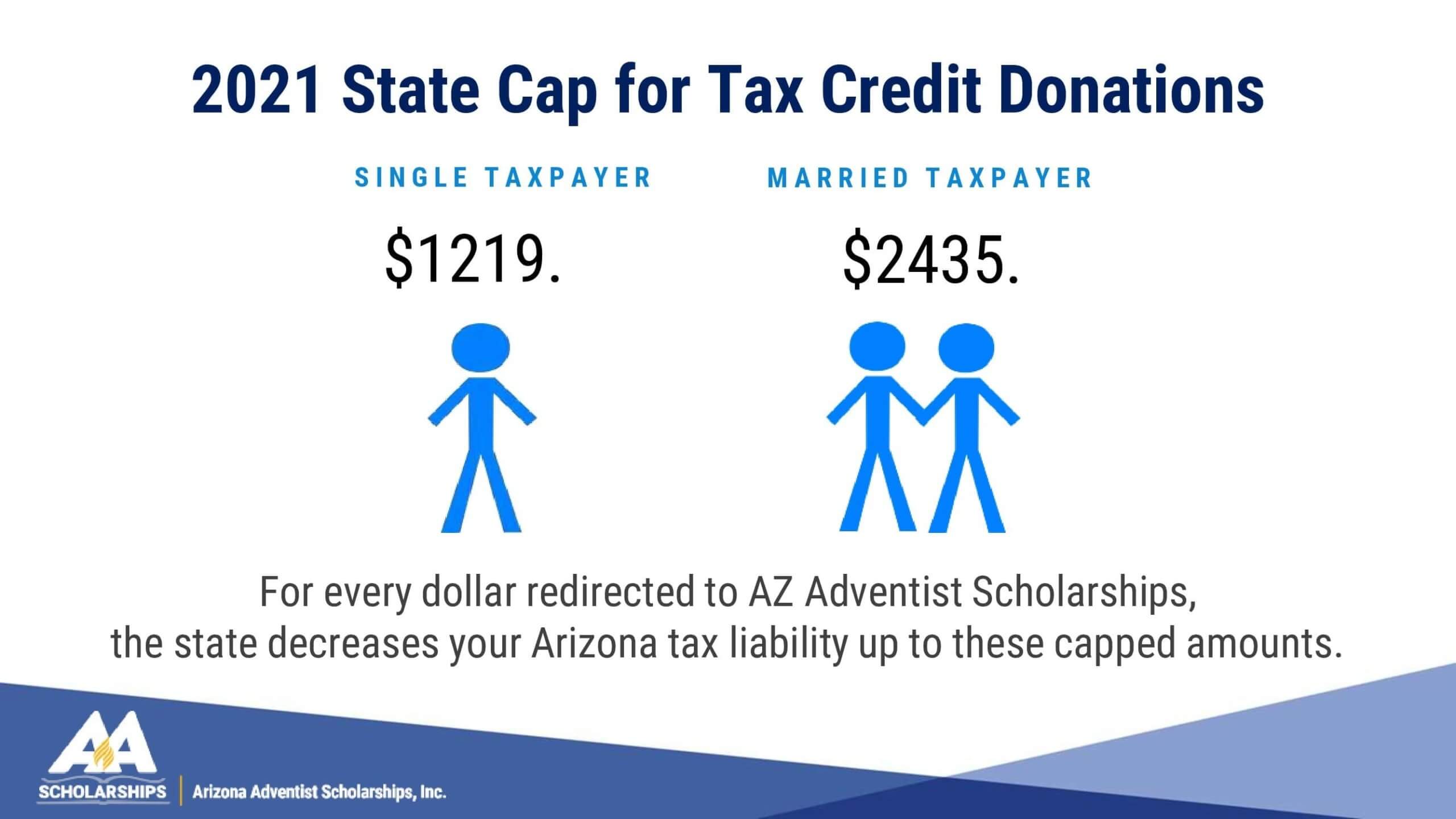

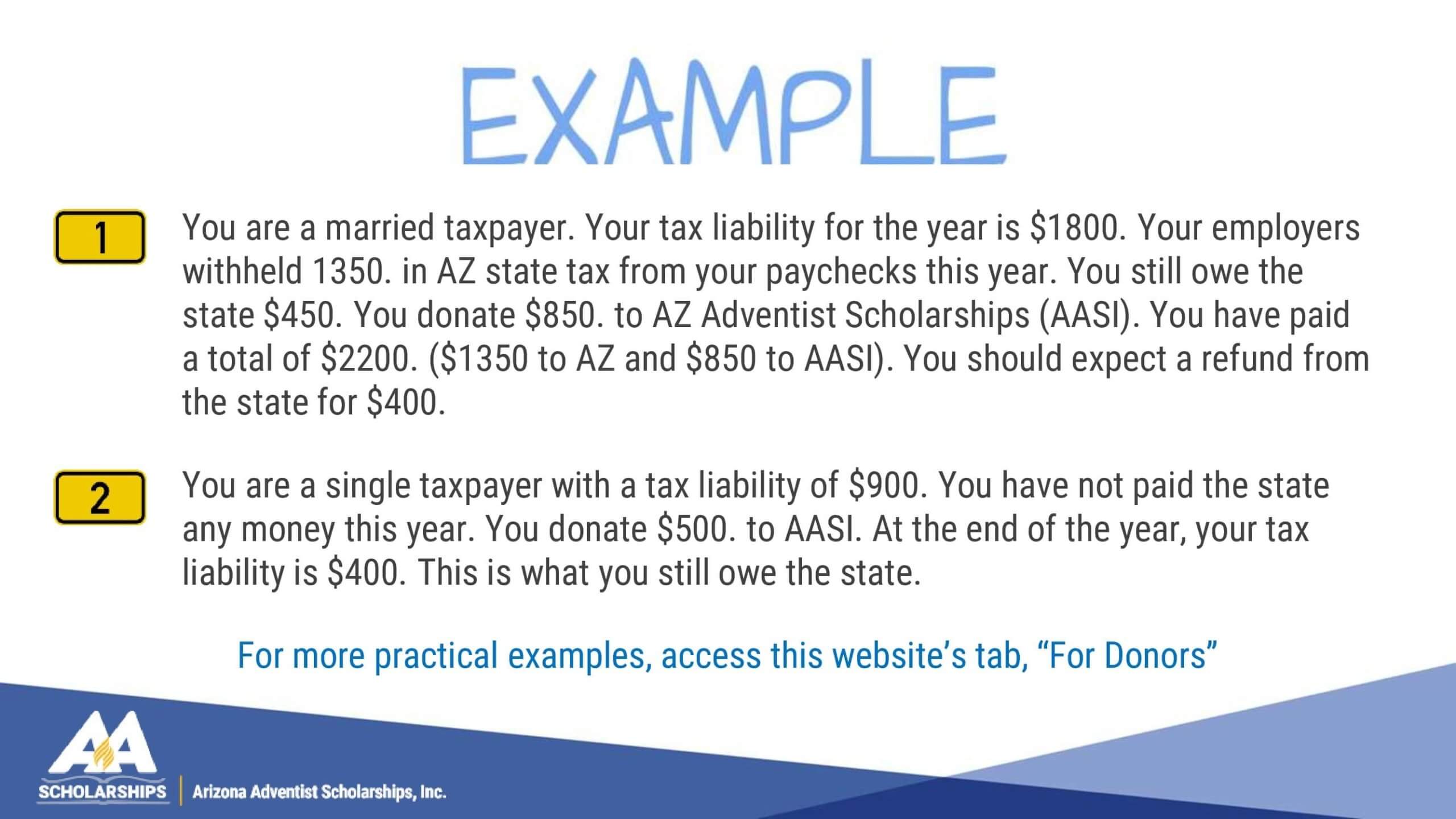

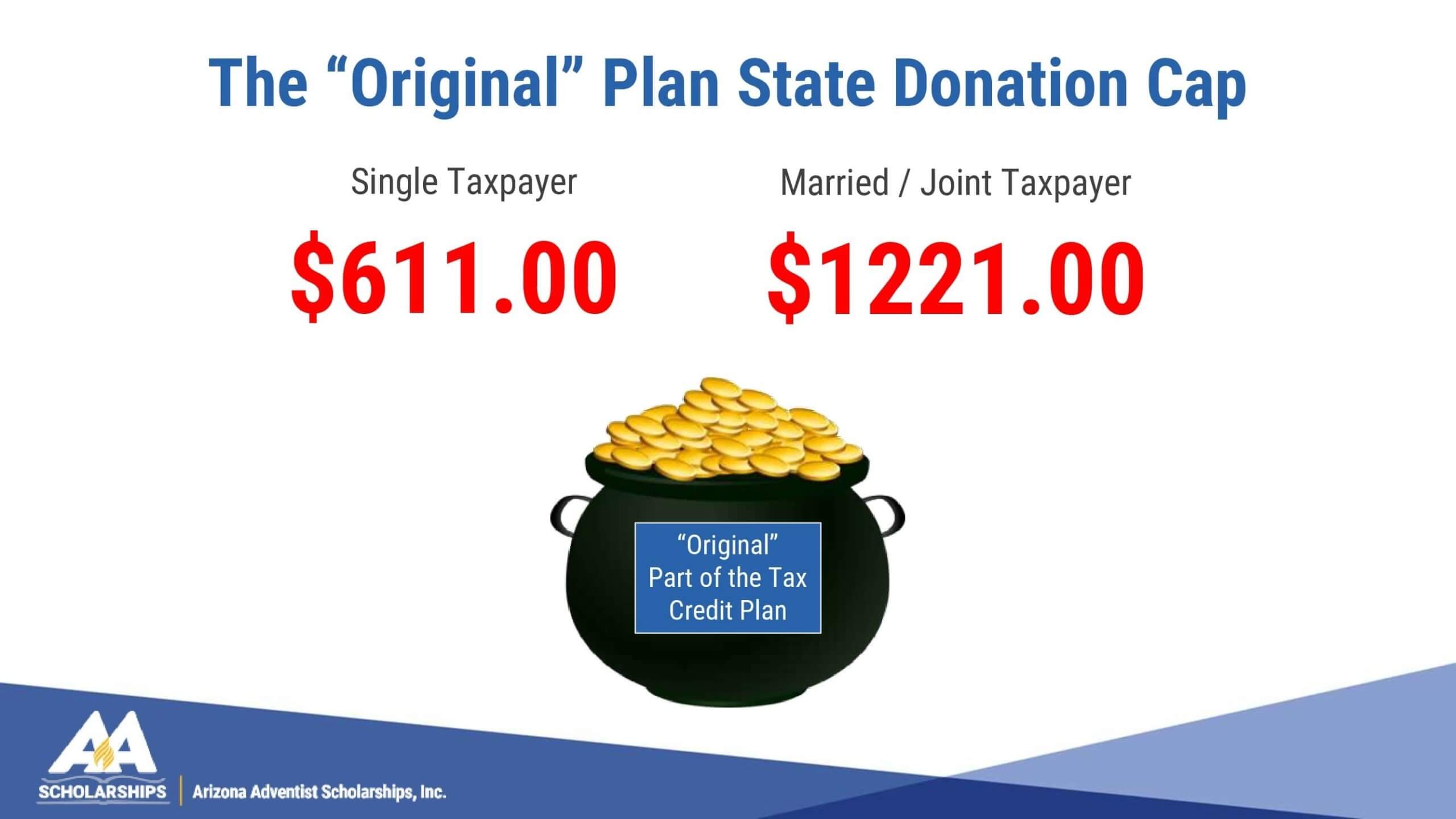

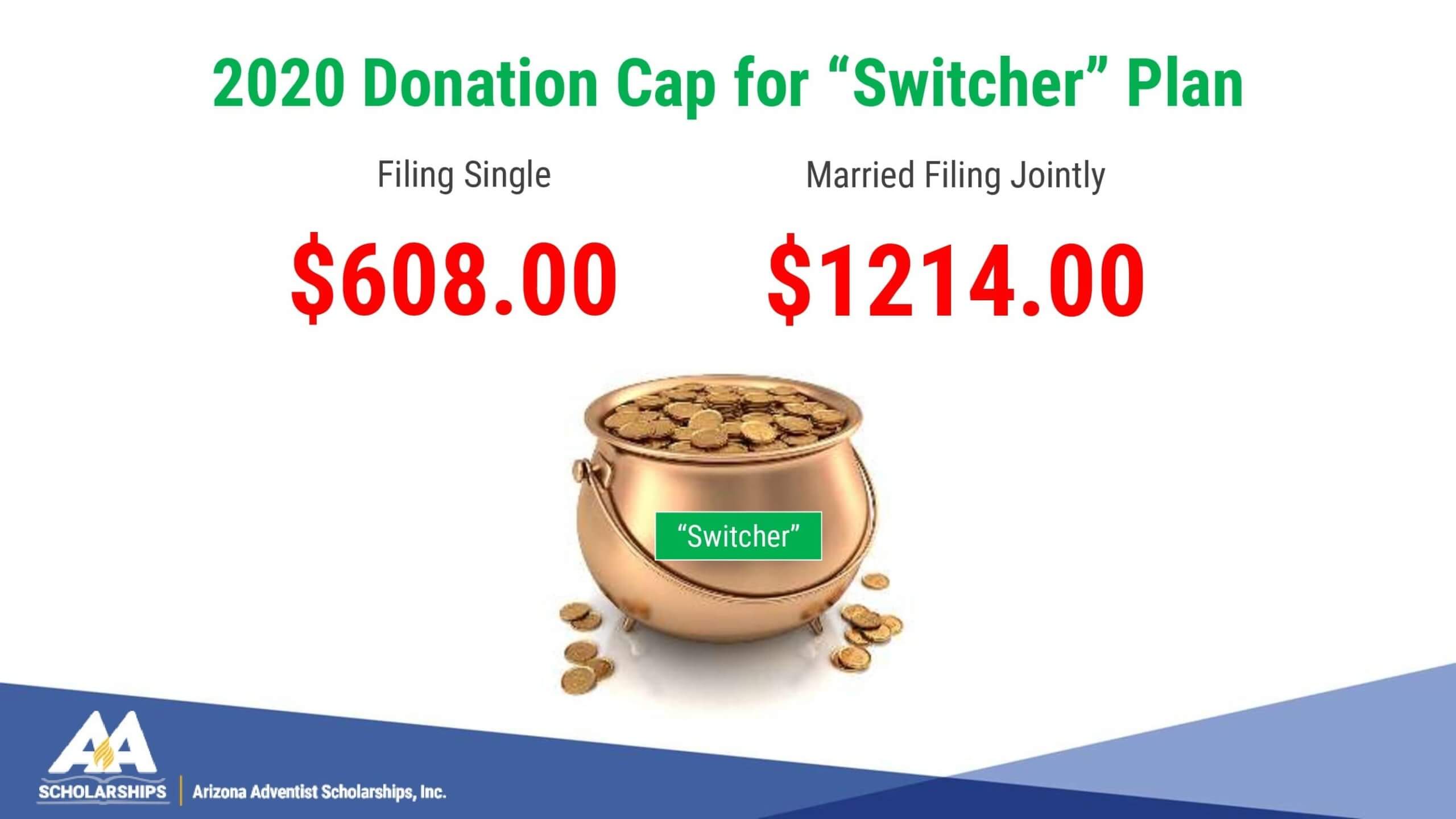

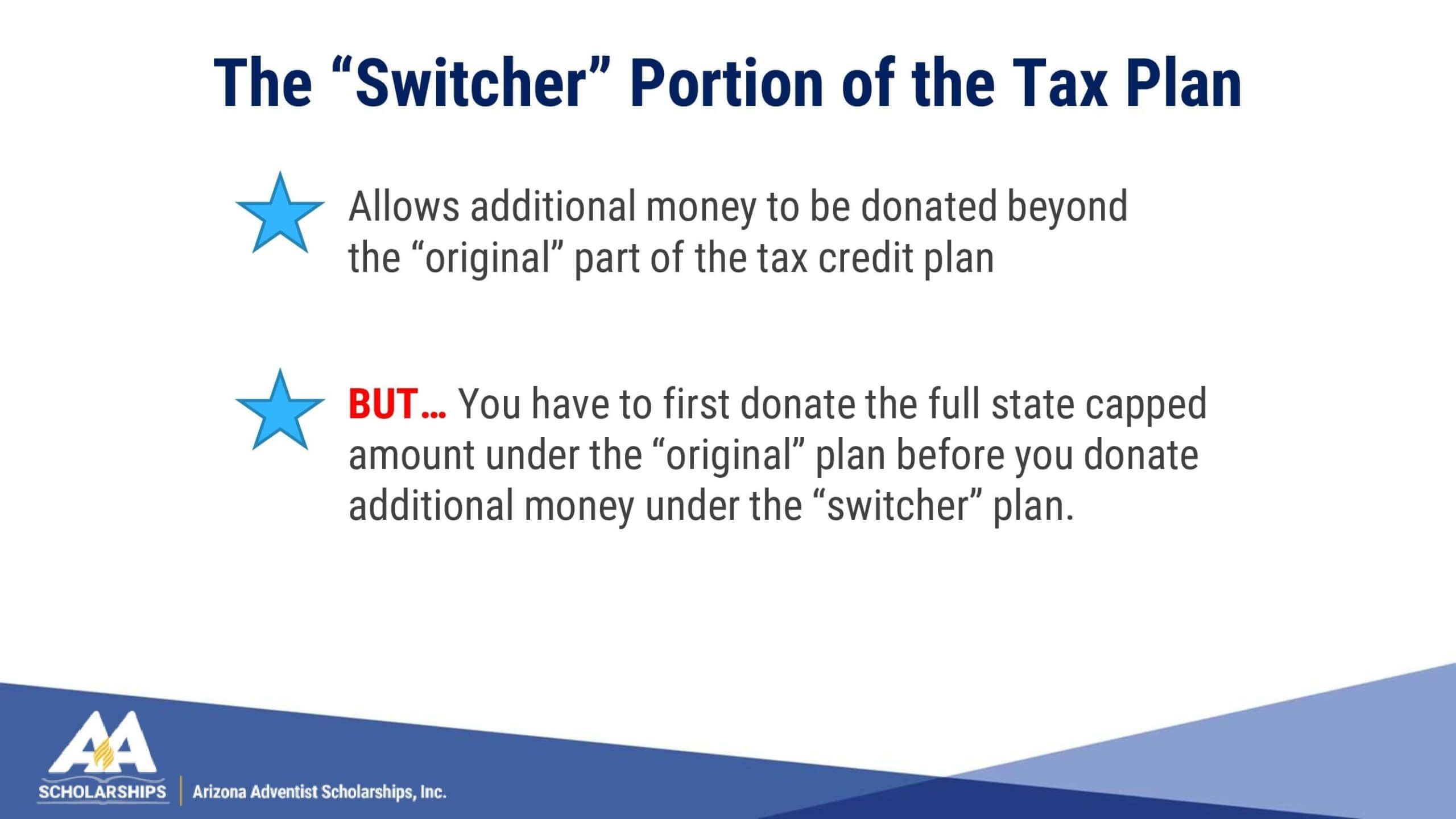

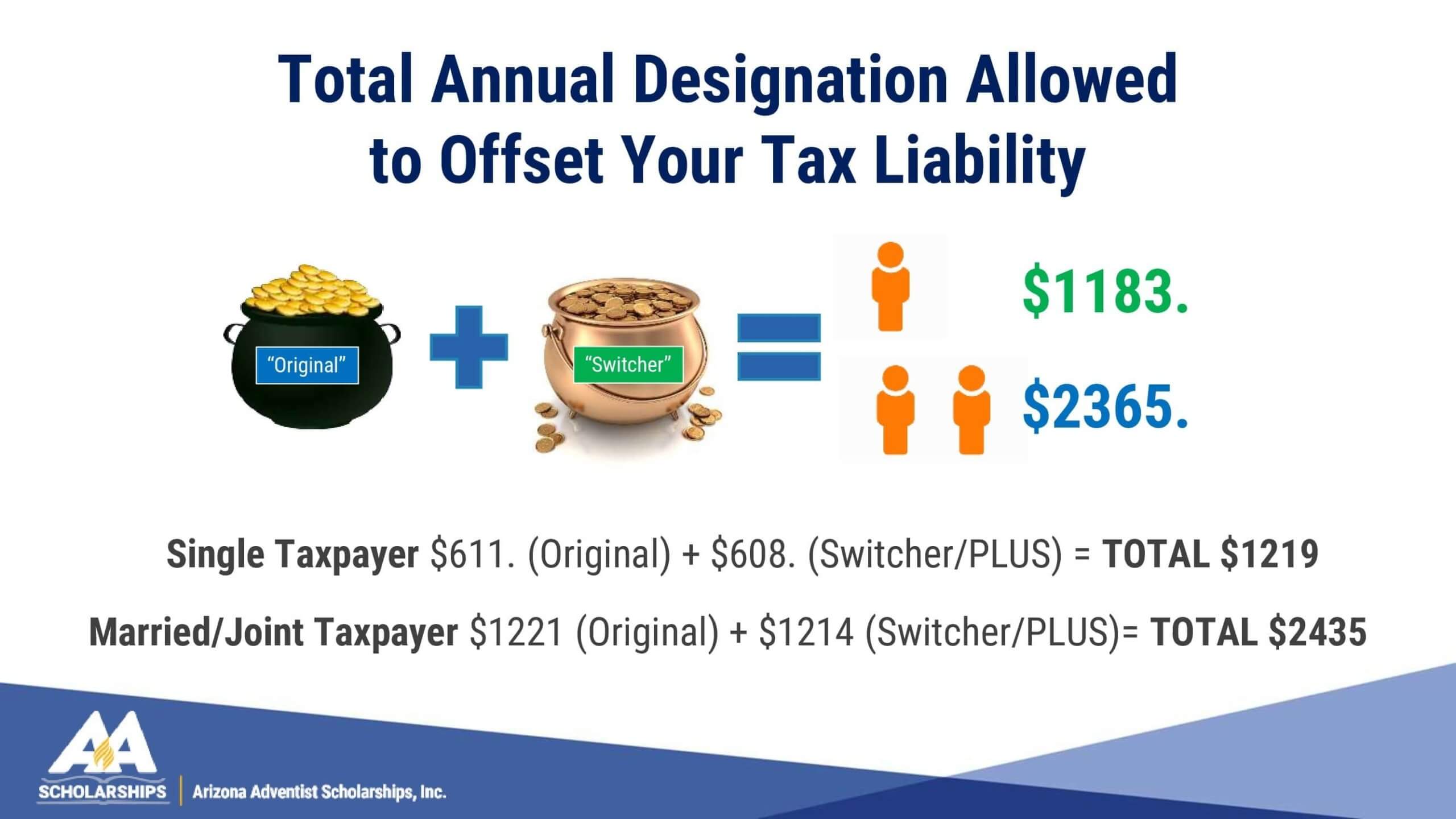

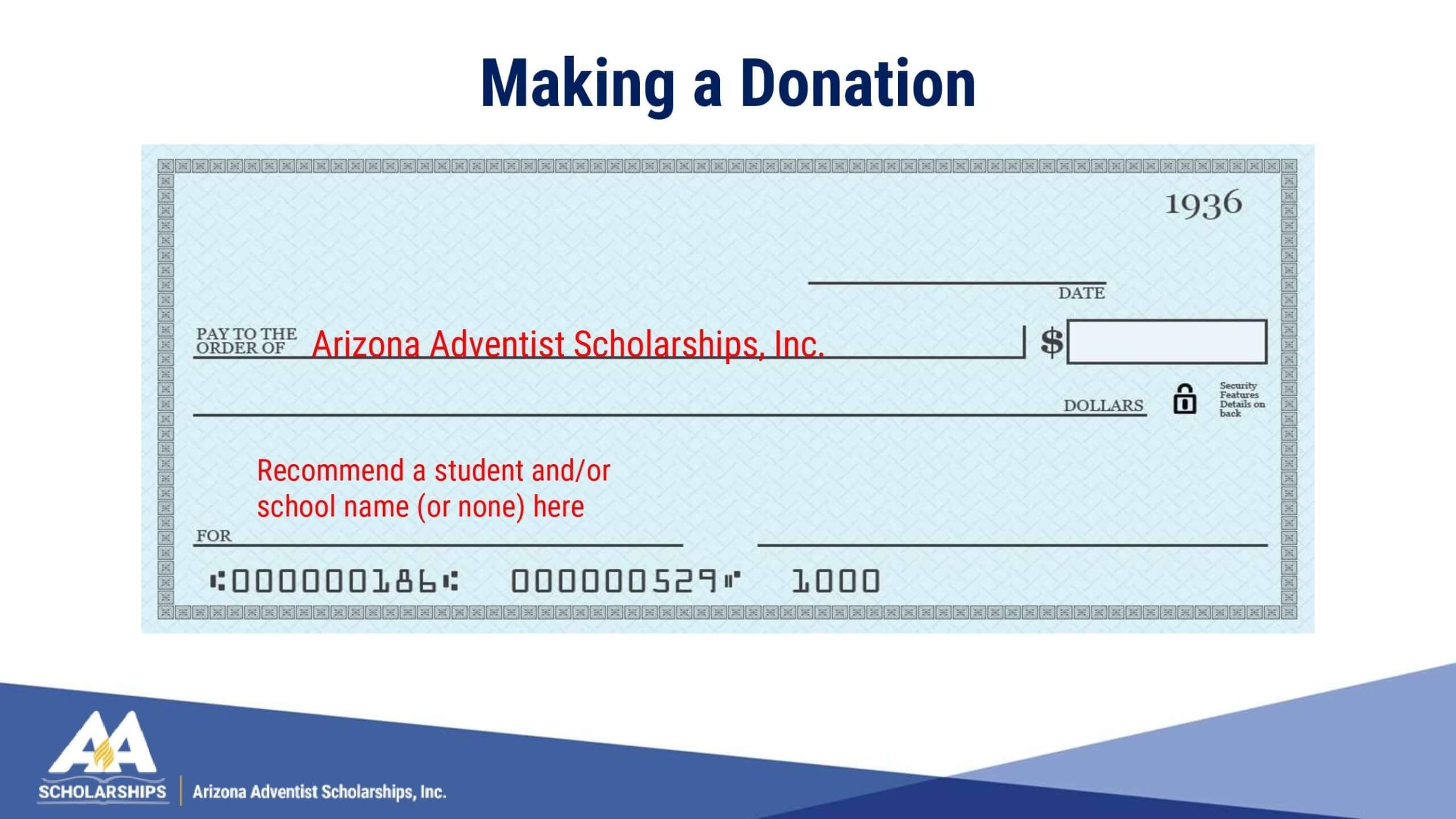

Arizona’s Private School Tax Credit allows you to give a donation to Arizona Advenstist Scholarships Inc. to provide scholarships for school-aged children.

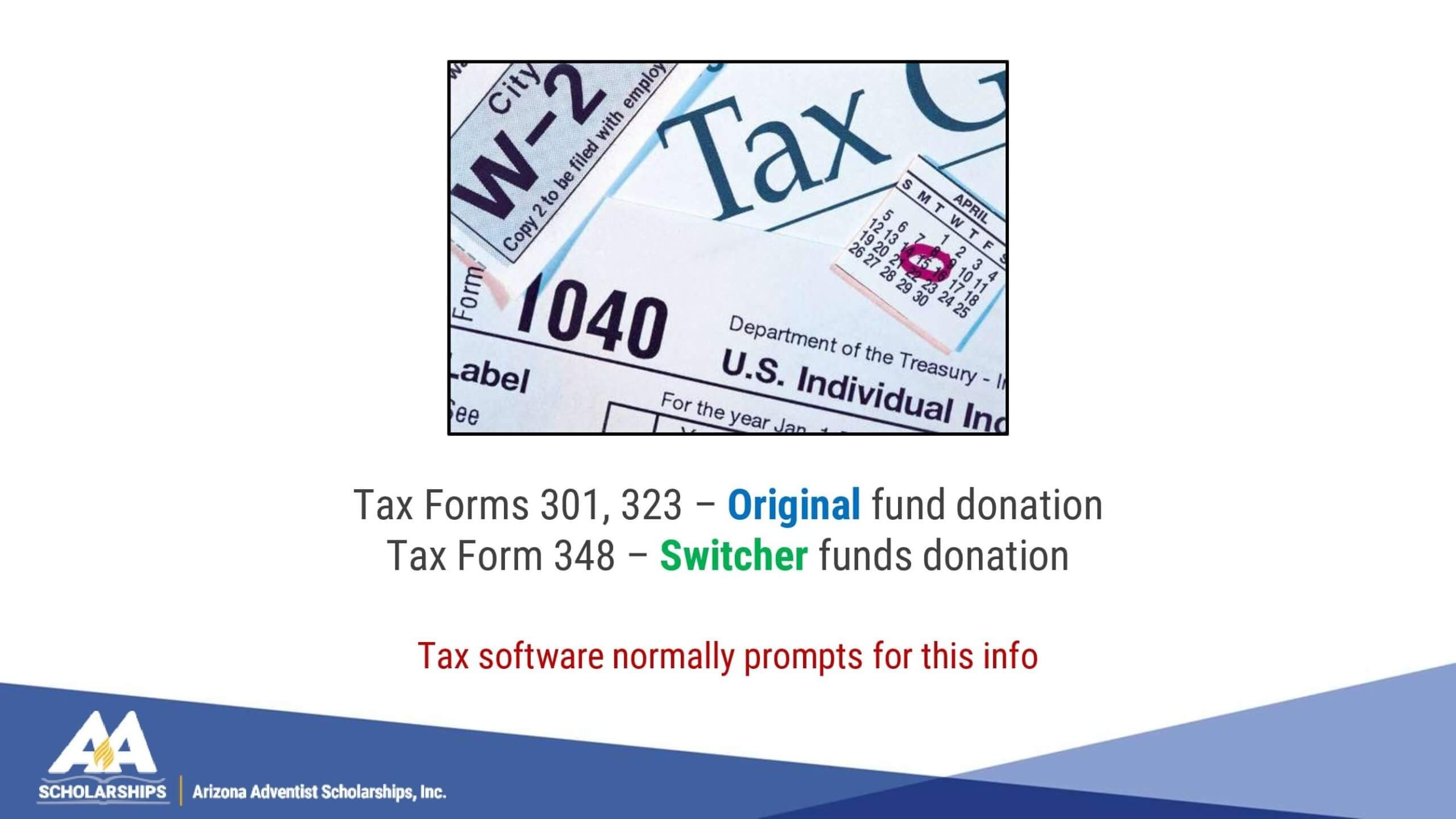

Arizona Adventists Scholarships, Inc. will send you a receipt to include when you file your state taxes.

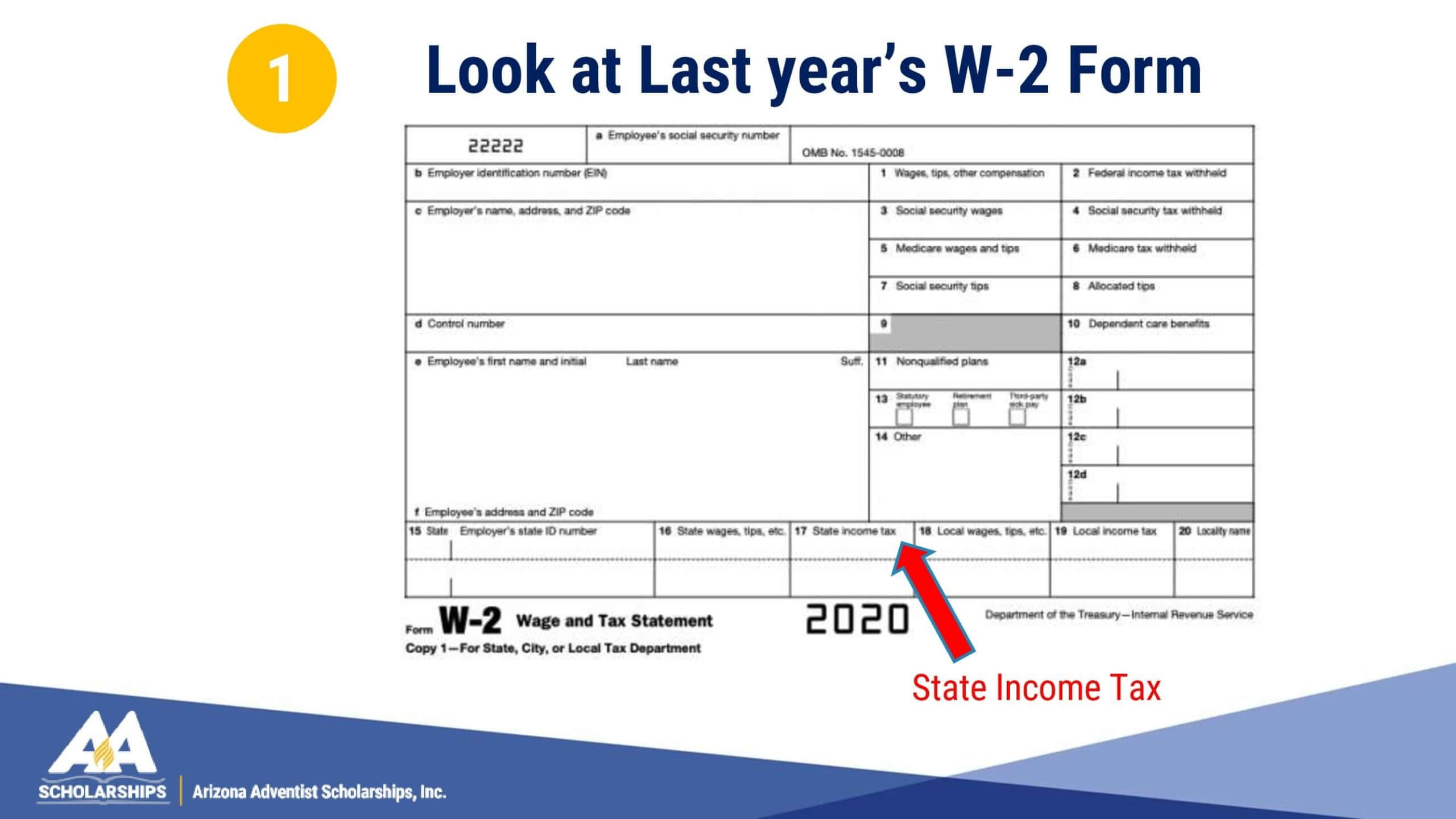

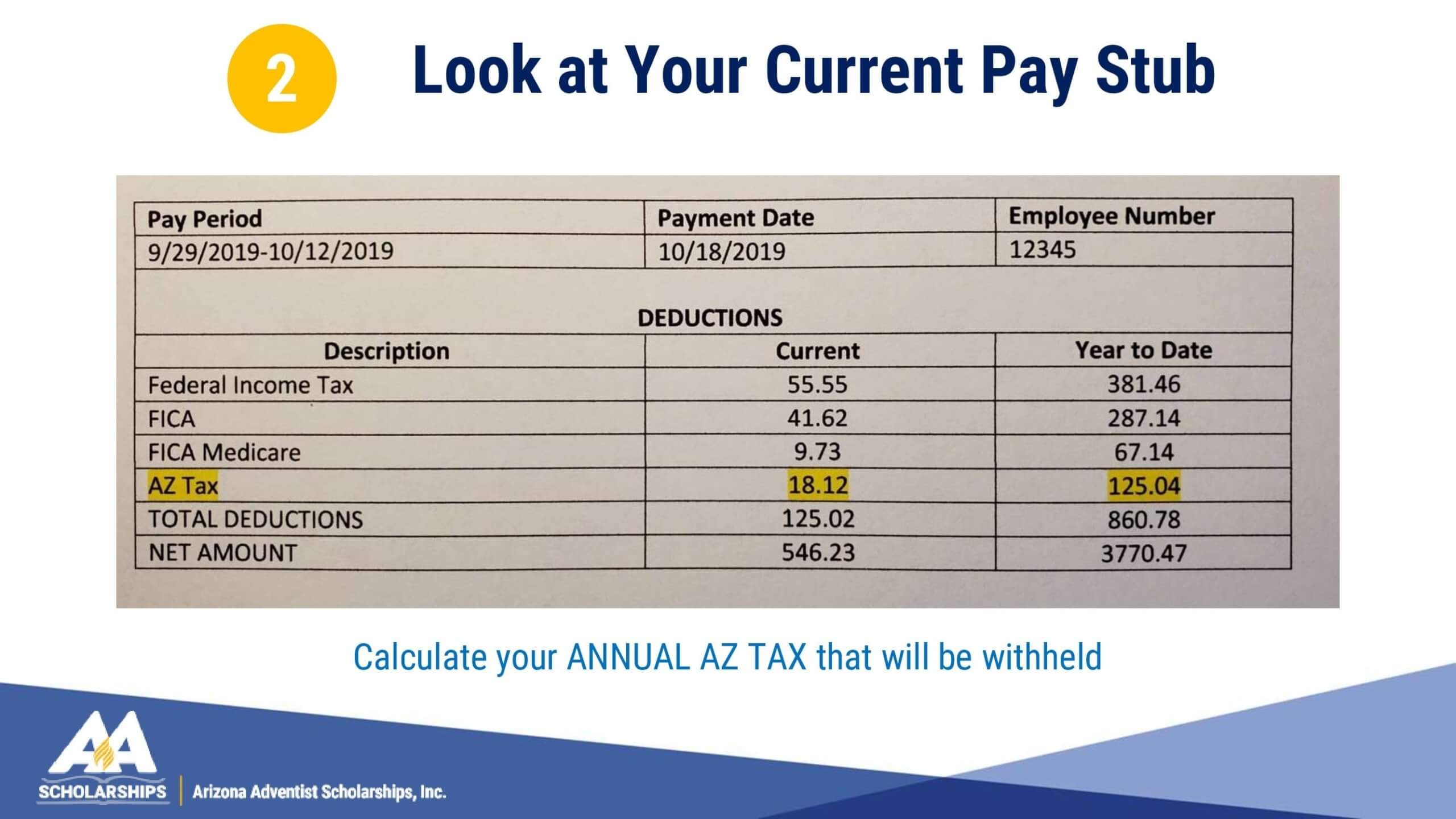

In exchange for your donation, you can get a direct, dollar-for-dollar credit toward the amount you pay in Arizona state taxes.

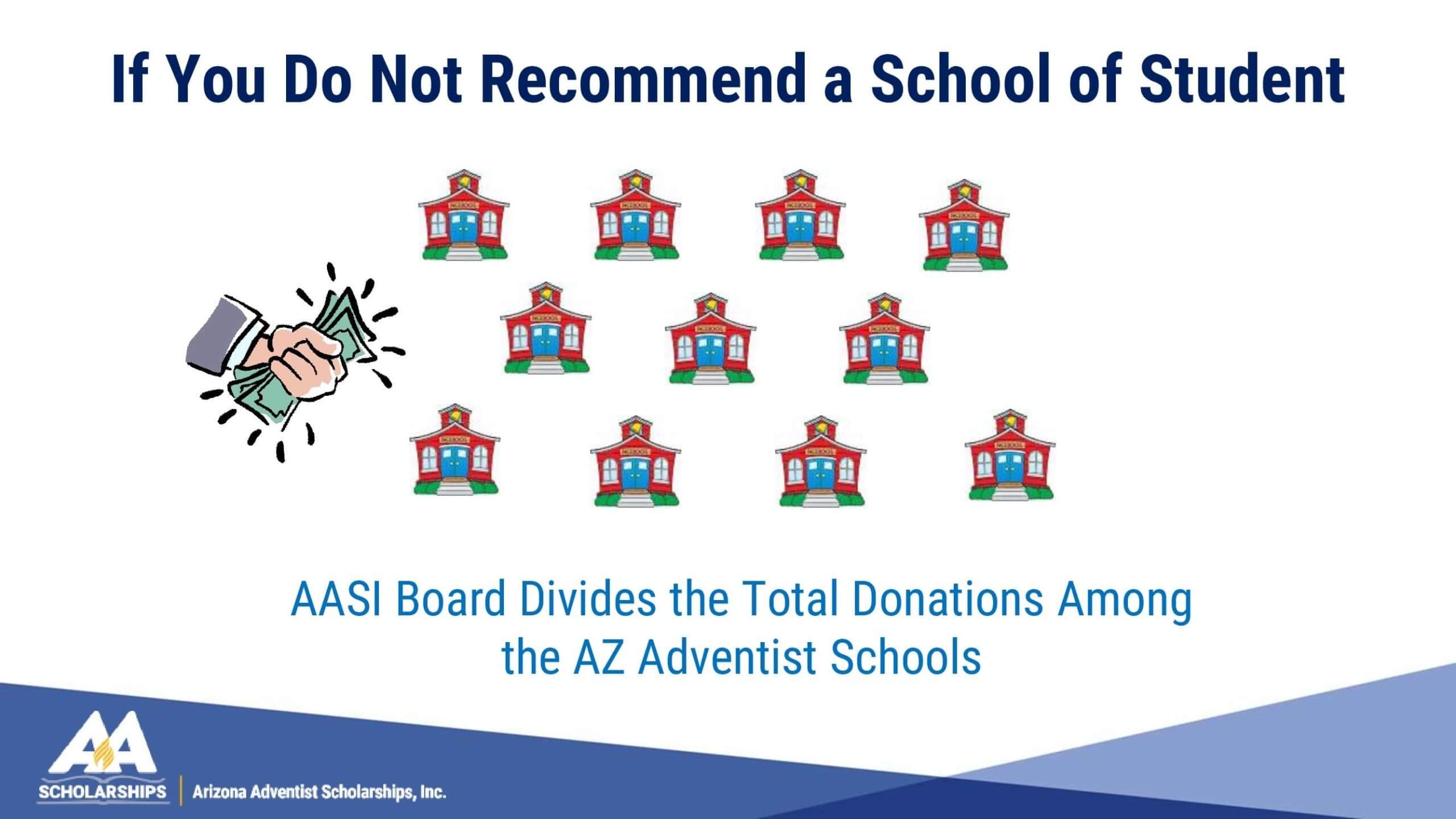

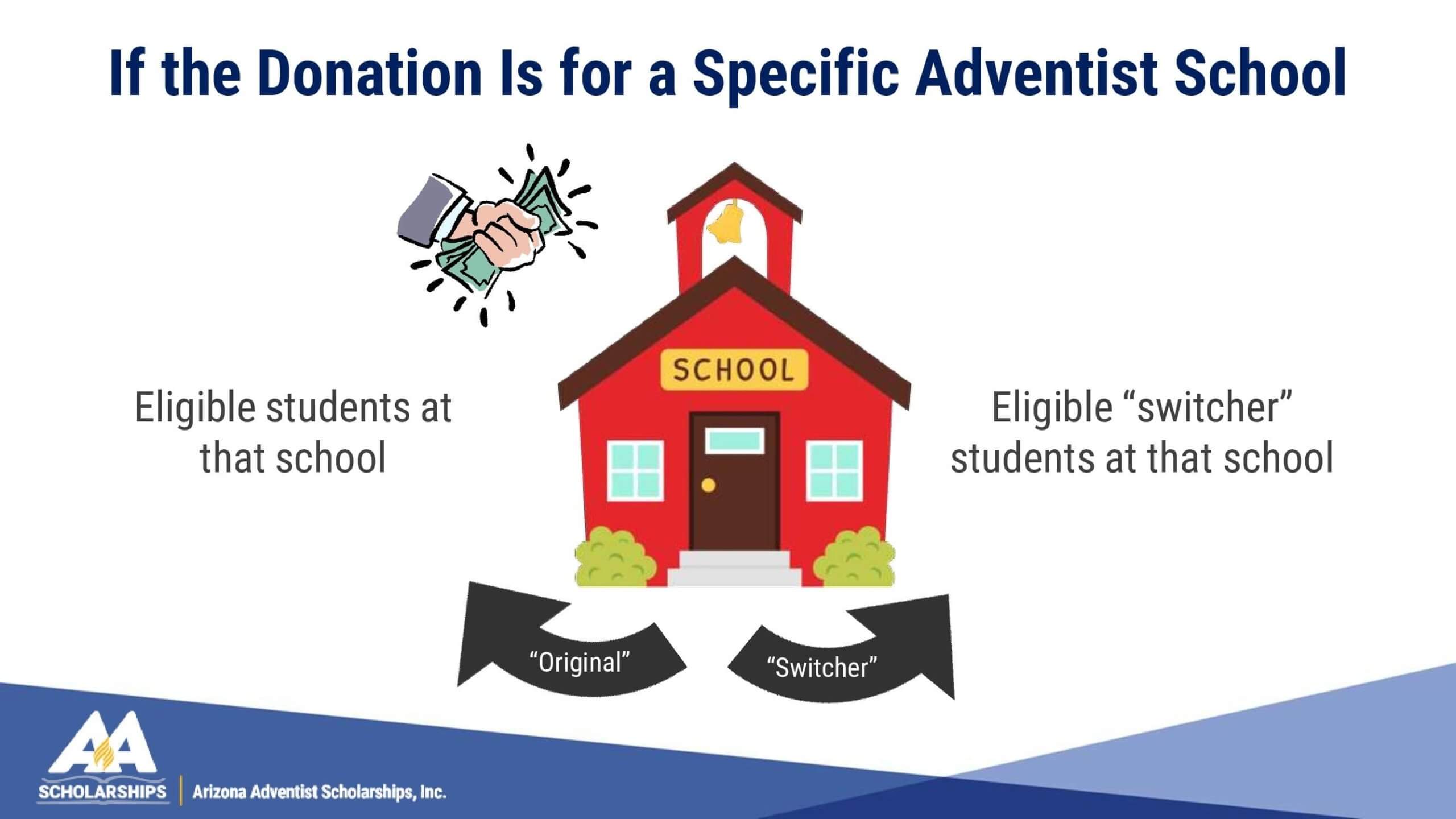

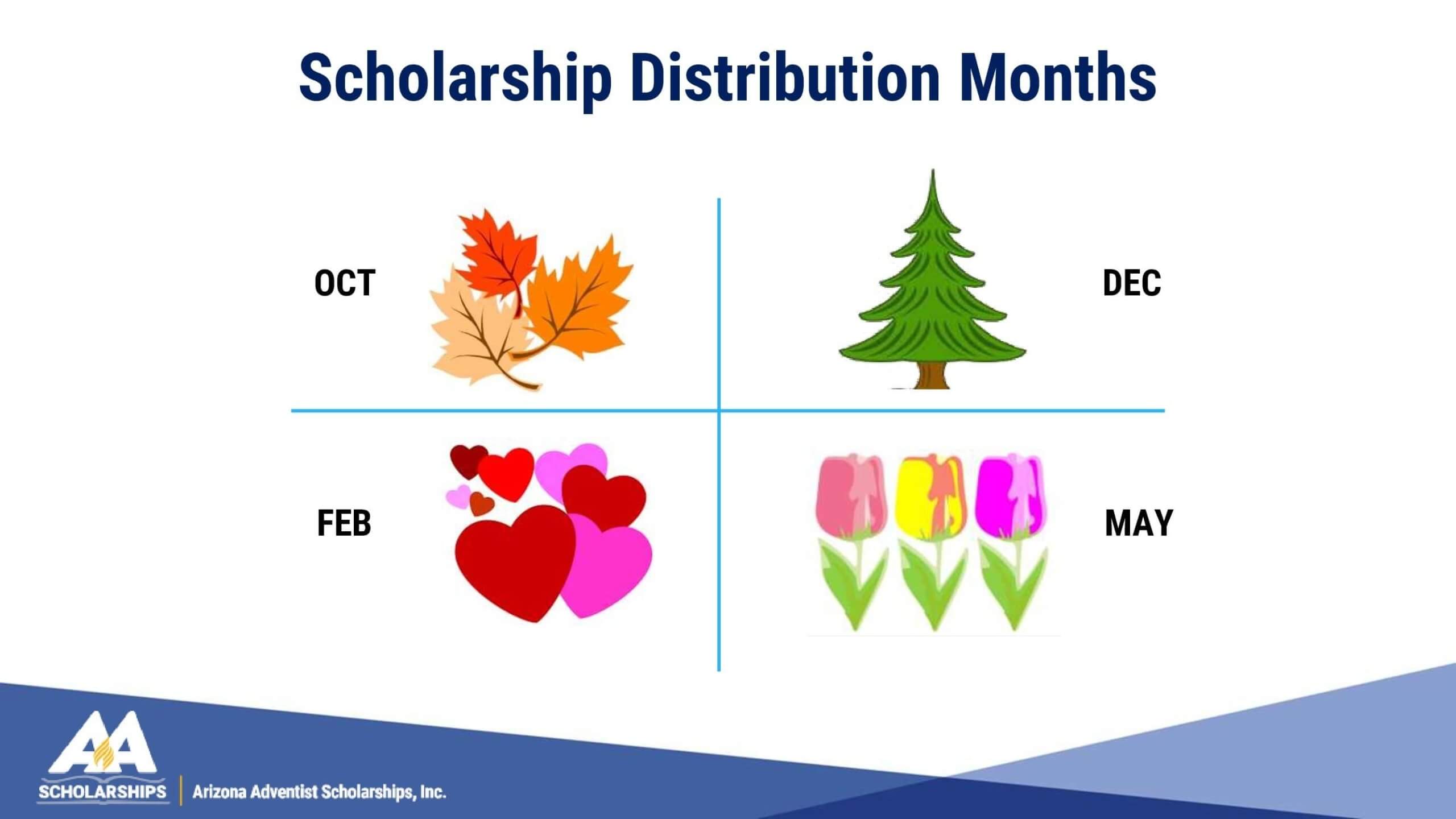

Arizona Adventist Scholarships, Inc. then awards scholarships to children attending Adventist schools in Arizona.

Note: A school tuition organization cannot award, restrict or reserve scholarships solely on the basis of donor recommendation.

A taxpayer may not claim a tax credit if the taxpayer agrees to swap donations with another taxpayer to benefit either taxpayer’s own dependent. A.R.S. § 43-1603 (B) (3)